How you pay your suppliers could be costing you. If you’re paying by Check and/or ACH, you’re likely leaving a significant amount of money on the table. With over 700,000 participating suppliers on our partner’s platform, adding their virtual payment card solution to your payment mix could both save and earn you a significant amount of money. If you have suppliers not yet on their platform, they can easily enroll them. There’s no cost to you, just your participation. In exchange, you earn revenue in the form of rebate checks paid quarterly that add to your bottom line or used to fund other CAPEX or OPEX strategic initiatives.

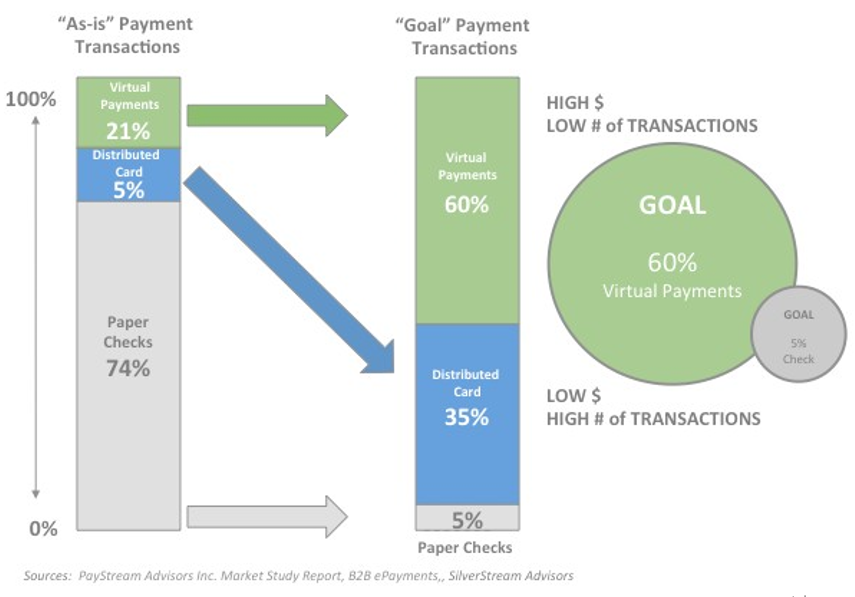

Here’s how it works…it’s not an all or nothing solution. You will continue to pay some suppliers by check and/or ACH, but some (usually no less than 20%) can be paid through their virtual credit card solution. This 20% adds up quickly. They strive to get 60% of your payments on their platform to maximize your savings. Here is an example of a typical client utilizing our platform:

$125M Annual Revenue

$93.75M Annual AP Spend (75%)

$18.75M Converted to VC Payments (20%)

Client Annual Savings/Returns: $210,938

– 5-Year Savings/Returns: $1,054,690

– 10-Year Savings/Returns: $2,109,380

Their virtual payment card platform provides the potential for AP process to fund capital projects, including payment automation, e‐invoicing systems and ERP conversion, through revenue share.

Daunted by the prospect of going all—virtual with your payments? Guess what: You don’t have to. A healthy AP process relies on an optimized mix of virtual, distributed card and good, old–fashioned checks. The goal is to shift AP department activity from labor-intensive to less-manual automated processes.

The goal is to optimize your payment mix so you can maximize your savings using their virtual credit card platform. There are many more benefits than just saving money from the card providers:

- Supplier uses buyer’s one-time (or single-use) card information

- Card limit matches amount of invoice being paid

- Buyer isn’t required to store supplier banking information

- Card information can be protected by password provided to the supplier

- Merchant bank handles all OFAC and Patriot Act requirements for buyer

- Eliminates Payment Card Industry (PCI) compliance issues

- Low potential for fraud/security breach

In the spirit of under promise and over deliver, estimate your annual savings using the calculator below (only modify salmon colored fields):

Give us a little bit of info about your organization’s AP needs, and we’ll give you a quick call to discuss how Virtual Payments Technology can help. The more detail you can provide, the better we can serve you.

[wpforms id=”759″ title=”true”]